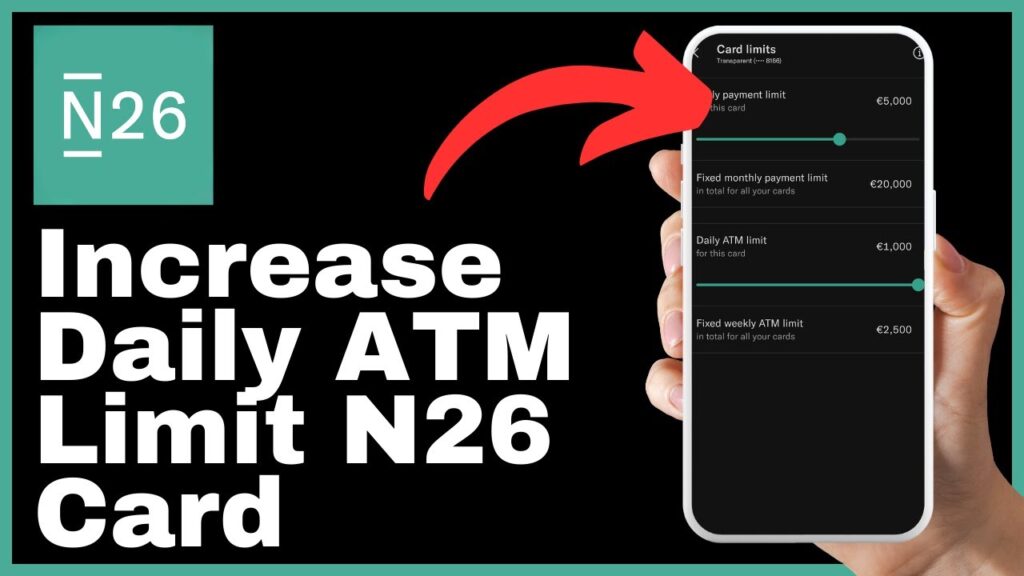

Increase your daily ATM withdrawal limit on your N26 card with ease, ensuring you have access to your funds whenever you need them. In this video by Media Magnet Guide, we will walk you through the steps to increase your daily ATM limit on your N26 card. By following this simple process, you can take control of your finances and have the flexibility to withdraw more cash when you require it.

To begin, open the N26 app on your device and navigate to the settings or my account section. From there, you can find the card settings or a similar option and select the specific N26 card for which you want to increase the daily ATM limit. Within the card settings, you’ll typically find the ATM withdrawal limit option. Simply adjust the limit to your desired amount, confirm the change for security purposes, and wait for the new limit to become active. With this valuable tip, you can have peace of mind knowing that you have increased access to your funds with just a few simple steps.

Understanding N26 Card

The N26 card is a financial tool offered by N26 Bank, a modern banking institution that provides a seamless digital banking experience. With the N26 card, users have access to a variety of benefits and features that make managing their finances effortless. In this article, we will explore what makes the N26 card unique and how it can benefit you in your daily financial management.

About N26 Bank

N26 Bank is a leading provider of digital banking services, offering a wide range of features that empower users to take control of their finances. With N26, users can easily make payments, save money, and even invest. The bank operates in multiple countries and is accessible through various devices, making it a convenient choice for individuals seeking a modern and innovative banking experience.

Benefits of using an N26 card

Using an N26 card comes with several advantages that can enhance your financial management. Some of the key benefits include:

-

Convenience: The N26 card can be used for making payments both online and offline, offering you a convenient way to handle your financial transactions.

-

Security: N26 Bank prioritizes the security of its users’ funds and employs advanced security measures to protect against fraud and unauthorized access.

-

Flexibility: With the N26 card, you have the flexibility to manage your finances on the go. You can easily track your transactions, check your balance, and make changes to your account settings through the N26 mobile app or web version.

-

Cost-saving: N26 Bank is known for its transparent fee structure, offering its users a cost-effective banking solution. Users can enjoy free withdrawals at ATMs and competitive exchange rates for international transactions.

Overview of N26 card features

The N26 card comes with a range of features that cater to different financial needs and preferences. Some of the notable features include:

-

Contactless Payment: The N26 card supports contactless payments, enabling you to make purchases by simply tapping the card on a contactless-enabled terminal.

-

Real-time Notifications: The N26 app provides real-time notifications for every transaction made with the card, helping you keep track of your spending and detect any unauthorized activity.

-

MoneyBeam: This feature allows N26 users to send money instantly to other N26 users, making it convenient for splitting bills or sending money to friends and family.

-

Spaces: N26 Spaces is a feature that allows users to create sub-accounts within their main account, making it easier to save and organize their funds for different purposes.

Importance of ATM withdrawal limit

What is an ATM withdrawal limit?

An ATM withdrawal limit refers to the maximum amount of cash that you can withdraw from an ATM in a single day using your N26 card. This limit is imposed by the bank for security purposes and helps ensure the safety of your funds.

Significance of ATM limits in financial management

ATM withdrawal limits play a crucial role in financial management as they help prevent unauthorized access to your account and mitigate the risk of theft or fraud. By setting a limit, you have control over the amount of cash that can be withdrawn, providing an additional layer of security for your funds.

General ATM withdrawal limits for N26 cards

The general ATM withdrawal limit for N26 cards is set at €2,500 per day. However, this limit may vary depending on the type of account you have and any specific restrictions imposed by N26 Bank. It is important to note that ATM operators may also impose their own limits, which can further restrict the amount you can withdraw in a single transaction.

Reasons for increasing daily ATM limit on N26 Card

There are several reasons why you may want to increase the daily ATM limit on your N26 card. Some of the key reasons include:

-

More purchasing power: Increasing the ATM limit allows you to have access to more cash, giving you greater purchasing power when you need it.

-

Emergency funds access: In situations where you may require a larger amount of cash, such as during emergencies or unexpected expenses, having a higher ATM limit can provide you with the necessary funds.

-

Increased financial flexibility: A higher ATM withdrawal limit offers you greater flexibility in managing your finances, allowing you to withdraw larger amounts of cash when necessary, without the need for multiple transactions.

Prerequisites for increasing ATM limit

Before you can increase the daily ATM limit on your N26 card, there are a few prerequisites that you need to fulfill. These include:

-

Having an active N26 account: To increase the ATM limit, you must have an active N26 account. If you don’t have one, you can sign up for an account through the N26 website or mobile app.

-

Access to N26 mobile app or web version: You need to have access to either the N26 mobile app or the web version in order to make changes to your account settings and increase the ATM limit.

-

Understanding basic navigation in N26 platform: Familiarize yourself with the navigation in the N26 app or web version to easily locate the necessary settings to increase the ATM limit.

Step-by-step process to increase daily ATM limit

To increase the daily ATM withdrawal limit on your N26 card, follow these step-by-step instructions:

Step 1: Open the N26 app on your device and log in if you haven’t already. Step 2: Navigate to the settings or my account section in the app’s main menu. Step 3: Look for the card settings or a similar option where you can manage your card preferences. Step 4: Select the specific N26 card for which you want to increase the daily ATM limit. Step 5: Find and tap on the ATM withdrawal limit option within the card settings. Step 6: Adjust the daily ATM withdrawal limit to your desired amount and confirm the change for security purposes.

Keep in mind that it may take a short time for the new limit to become active. Once updated, you will have access to a higher daily ATM withdrawal limit to meet your financial needs.

Timing and activation of the new ATM Limit

After adjusting the daily ATM withdrawal limit, you may wonder how long it takes for the new limit to become active. The duration for limit activation can vary depending on various factors, such as the processing time of N26 Bank and any technical constraints. It is advisable to check your N26 app or account periodically to ensure that the new limit has been activated.

Practical implications of increased daily ATM limit

Increasing the daily ATM limit on your N26 card can have several practical implications in your day-to-day financial management. Some of these implications include:

-

Meeting unplanned financial needs: By having a higher ATM limit, you can quickly access the cash you need for unforeseen expenses or emergencies, giving you peace of mind and financial security.

-

Enhancements in cash-based transactions: A higher ATM limit allows you to withdraw larger amounts of cash in a single transaction, making it more convenient and efficient for cash-based transactions, such as paying bills or making purchases in situations where card payments are not accepted.

Security considerations when increasing ATM limit

While increasing the ATM limit on your N26 card provides you with greater financial flexibility, it is important to consider security aspects when making changes to your account settings. Here are some tips to protect your N26 account:

-

Importance of secure practices: When updating the ATM limit or making any changes to your account settings, ensure that you are in a secure and private environment to prevent unauthorized access to your personal information.

-

Tips to protect your N26 account when changing settings: Use a strong and unique password for your N26 account, enable two-factor authentication, and avoid sharing sensitive account information with others. Regularly monitor your account for any suspicious activity and report any unauthorized transactions to N26 Bank immediately.

Common FAQs on daily ATM limit for N26 card

Here are some general queries and concerns regarding increasing the daily ATM limit on your N26 card:

-

General queries on increasing daily ATM limit: Users may have questions about the maximum limit they can set, the frequency of limit changes, and any fees associated with increasing the limit. It is recommended to refer to the N26 Bank website or contact their customer support for detailed information specific to your account.

-

Resolving potential issues: Users may encounter issues such as limits not being updated immediately or difficulties accessing the necessary settings. In such cases, it is advisable to reach out to N26 Bank’s customer support for assistance and guidance.

-

Finding additional resources on ATM limits: If you require more information on ATM limits or want to explore additional resources, visit the N26 Bank website or refer to the documentation available on their official platforms.

Conclusion

In conclusion, increasing the daily ATM withdrawal limit on your N26 card offers you greater financial flexibility and convenience. By following the step-by-step process outlined in this article, you can easily adjust the ATM limit to meet your specific needs. With the increased limit, you can confidently handle unexpected expenses and have access to emergency funds when necessary. Remember to prioritize security practices when making changes to your account settings and consult the N26 Bank resources for any further queries or concerns. Enjoy the benefits of a higher ATM limit and take control of your finances with N26 Bank.