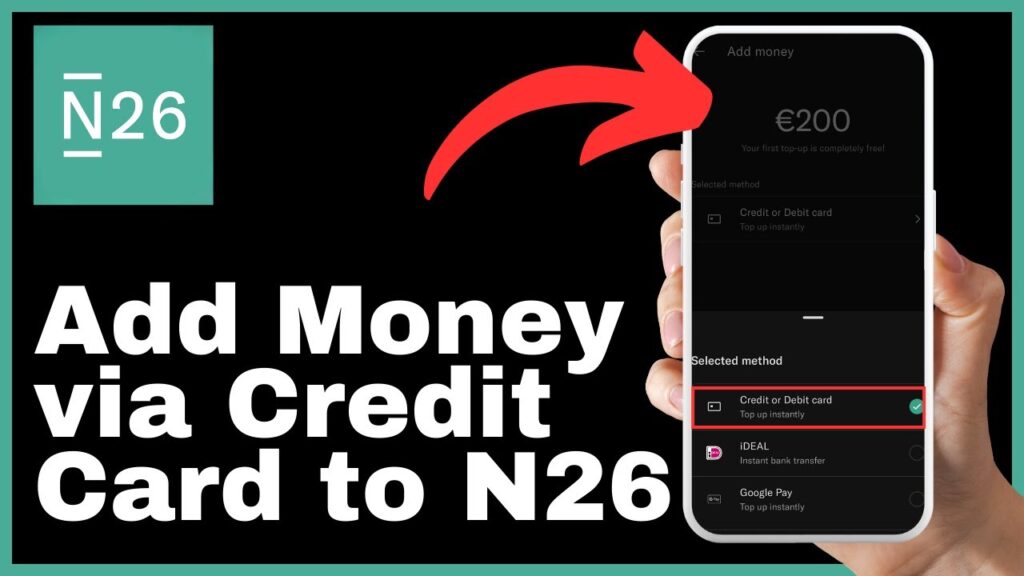

Discover the convenience of adding funds to your N26 account using your credit or debit card, ensuring quick access to your finances. In this video, the Media Magnet Guide walks you through a step-by-step process on how to add money to your N26 account via credit or debit card. With N26 Bank, you can effortlessly manage your money, make payments, save, and invest, all from the comfort of your digital device. This tutorial provides a simple and efficient way to ensure you always have the funds you need at your fingertips.

To add money to your N26 account via credit or debit card, start by opening the N26 app on your mobile device and logging in if needed. Then, navigate to the main menu and find the “Add money” or “Topup” option. From there, you’ll be prompted to choose your funding source, enter the desired amount, and provide your card details. Finally, authorize the transaction and your funds will be added to your N26 account, ready for your financial needs. This video tutorial aims to make your financial life easier, so be sure to subscribe, hit the notification bell, and leave any thoughts or questions in the comments section.

Understanding N26 Bank

Overview of N26 Bank

N26 Bank is a leading digital banking platform that offers a seamless and innovative banking experience. With N26, you can take control of your finances and manage your money effortlessly. Whether it’s making payments, saving, or investing, N26 provides the tools and features to simplify your financial life. Available in multiple countries and accessible on all your devices, N26 is the passport to modern banking.

The convenience of N26 digital banking

One of the key benefits of N26 Bank is the convenience it offers to its users. By using the N26 app, you can easily access your account and perform various banking transactions from the comfort of your own home or on the go. Adding funds to your N26 account via credit or debit card is a quick and efficient process, ensuring that you always have the funds you need at your fingertips.

Available options in managing money with N26

N26 Bank provides a range of options for managing your money. In addition to adding funds to your account, you can make payments, set up savings goals, and even invest your money. The N26 app offers a user-friendly interface that allows you to navigate through these options with ease. With N26, you have the flexibility to manage your finances in a way that suits your needs and goals.

Insight into account accessibility of N26

One of the key advantages of N26 Bank is its accessibility. Regardless of whether you use a smartphone, tablet, or computer, you can access your N26 account from any device with an internet connection. This means that you can check your balance, make payments, and manage your finances wherever you are. The N26 app is designed to provide a seamless and consistent banking experience across all your devices.

Before You Start

Confirming your N26 account status

Before you can add money to your N26 account, it is important to confirm the status of your account. Ensure that your account is active and in good standing. If you are unsure about the status of your account, contact N26 customer support for assistance.

Ensure you have the N26 App

To add money to your N26 account via credit or debit card, you will need to have the N26 app installed on your mobile device. If you have not already done so, download the N26 app from the App Store or Google Play Store and complete the installation process.

Checking for sufficient funds on your credit or debit card

Before initiating the transaction to add money to your N26 account, it is essential to ensure that you have sufficient funds available on your credit or debit card. Check your card balance to make sure that you can cover the transaction amount.

Understanding the necessary transaction information needed

When adding money to your N26 account via credit or debit card, you will need to provide specific transaction information. This includes the card number, expiration date, and security code (CVV). Make sure you have this information readily available before starting the process.

Accessing Your N26 Account

Opening your N26 app

To access your N26 account, open the N26 app on your mobile device. If you are not already logged in, enter your credentials to proceed.

Logging into your N26 account

Once you have opened the N26 app, log into your account using your username and password. If you have enabled biometric authentication, you can use your fingerprint or facial recognition to log in.

Navigating the N26 account interface

Upon logging into your N26 account, you will be presented with the account interface. This interface provides a summary of your account balance, recent transactions, and other relevant information. Familiarize yourself with the different sections and menus to navigate through your account easily.

Understanding the N26 account main menu

The N26 account main menu is where you can access various features and perform different transactions. Look for the “Add Money” or “Top-up” option in the main menu to initiate the process of adding funds to your account via credit or debit card.

Initiating the Process to Add Money

Locating the ‘Add Money’ or ‘Top-up’ option

In the N26 account main menu, find the “Add Money” or “Top-up” option. This is the option that will allow you to initiate the transaction to add funds to your account.

Navigating initiation of transaction

Once you have located the “Add Money” or “Top-up” option, click on it to start the process. This will open a new screen or dialog where you can input the necessary information to complete the transaction.

Understanding the steps required towards transaction completion

Follow the steps provided on the screen or dialog to complete the transaction. The process may involve selecting the funding source, entering the transaction amount, providing card details, reviewing transaction details, and authorizing the transaction.

Selecting Your Funding Source

Understanding the different funding source options

When adding money to your N26 account via credit or debit card, you may have multiple funding source options available. These options could include different credit or debit cards linked to your account. Choose the funding source that you prefer for the transaction.

Choosing credit or debit card as your preferred funding source

To add money to your N26 account, select the option to use a credit or debit card as your preferred funding source. This will ensure that the transaction is processed using the selected card.

Confirming the choice of funding source

After selecting the credit or debit card as your funding source, confirm your choice to proceed. Review the selected card details and ensure that they are accurate before moving on to the next step.

Inputting Transaction Amount

Entering the desired amount to add to the N26 account

Enter the desired amount that you want to add to your N26 account. Make sure that the entered amount is correct and matches the funds you intend to transfer.

Checking to ensure transaction amount is accurate

Double-check the transaction amount to ensure that it is accurate before proceeding. This step is crucial to avoid any discrepancies or errors during the transaction process.

Finalizing the transaction amount

Once you have confirmed that the transaction amount is accurate, proceed to finalize the transaction amount. This will ensure that the correct amount is added to your N26 account.

Providing Your Card Details

Entering the credit or debit card number

Enter the credit or debit card number linked to the funding source you have chosen. Make sure to enter the card number correctly to avoid any issues with the transaction.

Entering the card expiration date

Input the expiration date of the credit or debit card. This information is necessary to validate the card and process the transaction successfully.

Inputting the security code (CVV)

Provide the security code (CVV) of the credit or debit card. The CVV is a three-digit number located on the back of the card. Carefully enter the correct CVV to ensure the transaction can be authorized.

Finalizing card information

Review the entered card details to confirm that they are accurate. Any mistakes or errors in the card information could result in a failed transaction. Once you have verified the information, proceed to the next step.

Reviewing the Transaction Details

Ensuring all transaction details are correct

Before authorizing the transaction, review all the transaction details to ensure they are correct. This includes the funding source, transaction amount, and card information. Accuracy in the transaction details is essential for a successful transfer of funds to your N26 account.

Understanding the importance of accurate transaction details

Accurate transaction details are crucial to prevent any errors or issues during the transfer process. Reviewing the details beforehand can help identify and rectify any mistakes, ensuring a smooth transaction.

Confirming all transaction information

After reviewing the transaction details and ensuring their accuracy, confirm all the information to proceed with the transaction. This confirmation is necessary to ensure that the funds are transferred to your N26 account correctly.

Authorizing the Transaction

Understanding required authorization steps

To authorize the transaction, follow the necessary steps provided on the screen. These steps may include confirming your identity through biometric authentication or entering a verification code sent to your registered mobile number or email.

Possible requirement for verification code from the bank

Depending on your bank, you may be required to enter a verification code to authorize the transaction. This code is usually sent to your registered mobile number or email. Enter the code accurately to proceed with the transaction.

Confirming transaction authorization

Once you have completed the required authorization steps, confirm the transaction authorization. This final step ensures that the funds will be added to your N26 account successfully.

Completion of the transaction process

After confirming the transaction authorization, the process to add money to your N26 account via credit or debit card is complete. The funds will be added to your account and will be available for your financial needs.

Conclusion

Overview of process and benefits

Adding money to your N26 account via credit or debit card is a simple and efficient way to ensure you always have the funds you need at your fingertips. The convenience and accessibility of N26 Bank make managing your finances a breeze. With a seamless digital banking experience, N26 empowers you to take control of your finances and simplify your financial life.

Encouragement to use the N26 banking facilities

We encourage you to explore the world of modern banking with N26. Whether it’s making payments, saving, or investing, N26 provides the tools and features to support your financial goals. Take advantage of the convenience and flexibility offered by N26 Bank to streamline your banking experience.

Invitation to subscribe for more tips

If you found this guide helpful, subscribe to Media Magnet Guide for more informative and valuable content. Stay updated with the latest tips, tutorials, and resources to enhance your financial knowledge and make the most of your N26 account.

Closing thoughts

Adding money to your N26 account via credit or debit card is just one of the many features and benefits that N26 Bank offers. Explore the possibilities and discover how N26 can transform your banking experience. Join the world of modern banking with N26 today and embark on your financial journey with confidence.