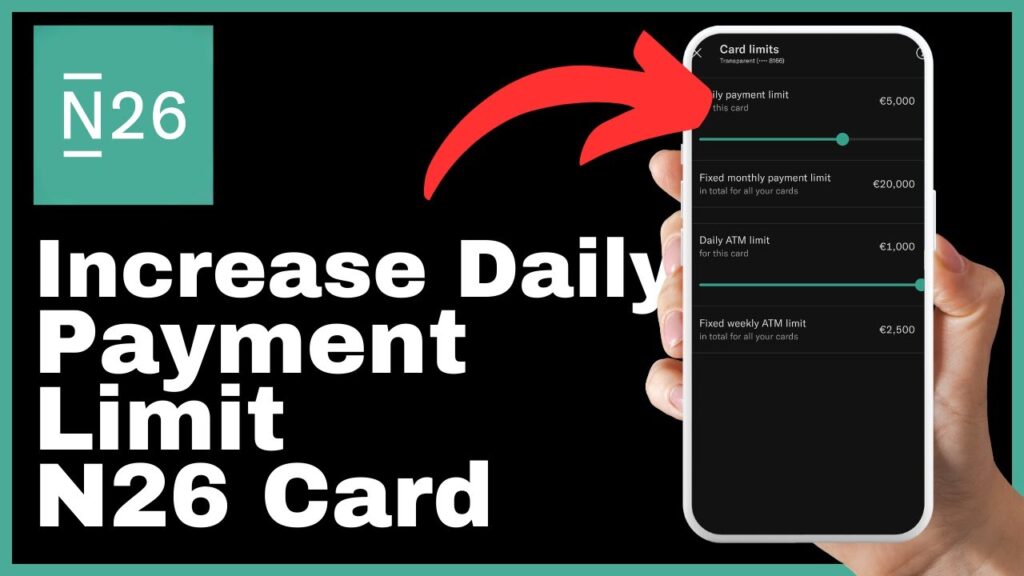

The article titled “How to Increase Daily Payment Limit N26 Card” provides a step-by-step guide on adjusting the daily payment limit for your N26 card. The video, created by Media Magnet Guide, aims to help you meet your financial needs and enhance flexibility in your spending. By following the instructions outlined in the video, you can easily increase the daily payment limit on your N26 card, allowing for larger transactions or online purchases without any hassle. The article emphasizes the importance of managing your finances more effectively and offers additional tutorials and resources on Mediamagnetguide.com to further enhance your financial knowledge and journey.

Increasing your daily payment limit is a game-changing tip for N26 card holders. This article highlights the benefits of adjusting your limit and provides clear instructions on how to do so. By following the step-by-step process outlined, you can gain more control over your finances, making it easier to handle bigger expenses or online shopping sprees. Share your thoughts, questions, or money-saving tips in the comments section below and don’t forget to subscribe to Media Magnet Guide for more valuable content.

Understanding the N26 Card

The N26 Card is a revolutionary financial tool that offers a seamless digital banking experience. With N26, you can take control of your finances and manage your money effortlessly, whether it’s making payments, saving, or investing. In this article, we will explore the features, benefits, and limitations of the N26 Card as well as provide a comprehensive guide on how to increase the daily payment limit.

Features of the N26 Card

The N26 Card comes with a range of features that make it a highly valuable financial tool. Some of the key features include:

- Contactless Payments: The N26 Card allows you to make contactless payments, making transactions quick and convenient.

- Mobile App Integration: The N26 Card seamlessly integrates with the N26 mobile app, providing you with real-time updates on your transactions and spending habits.

- Secure Payments: The N26 Card is equipped with advanced security features to protect your financial information and provide a safe payment experience.

- Global Acceptance: The N26 Card is accepted worldwide, allowing you to make transactions both domestically and internationally.

Benefits of Using the N26 Card

Using the N26 Card offers a range of benefits that enhance your financial management and spending experience. Some of the key benefits include:

- Convenience: With the N26 Card, you can make payments easily and quickly, eliminating the need for cash or physical cards.

- Budgeting Tools: The N26 mobile app provides powerful budgeting tools that help you track your spending, categorize your expenses, and set financial goals.

- Cost Savings: The N26 Card eliminates the need for additional fees associated with traditional banking, such as ATM fees or foreign transaction fees.

- Enhanced Security: The N26 Card provides advanced security features, such as biometric authentication and real-time transaction alerts, ensuring the safety of your financial information.

Countries Where N26 is Available

N26 is available in multiple countries, providing access to its innovative banking solutions to a global audience. Some of the countries where N26 is available include:

- Germany

- Austria

- France

- Spain

- Italy

- Ireland

Please note that the availability of N26 may vary depending on your location. It is recommended to visit the N26 website or contact customer support for the most up-to-date information on availability.

Current Limitations of N26 Card

While the N26 Card offers an array of features and benefits, it is important to be aware of its current limitations. Some of the key limitations of the N26 Card include:

- Limited Cash Withdrawal: The N26 Card has a daily cash withdrawal limit, which may vary depending on your account type and location.

- Transaction Limits: The N26 Card may have transaction limits, which restrict the amount you can spend on a single transaction.

- Currency Conversion Fees: If you make international transactions or withdrawals in a different currency, N26 may charge currency conversion fees.

- Limited Customer Support: Some users have reported challenges in reaching N26 customer support, which may result in delayed resolutions for account-related issues.

It is important to consider these limitations and assess whether they may impact your financial needs and requirements before deciding to use the N26 Card.

Need for Increasing Daily Payment Limit

As your financial needs evolve, you may find that the current daily payment limit on your N26 Card does not meet your requirements. Increasing the daily payment limit can provide you with the flexibility to make larger transactions or online purchases. In this section, we will explore the reasons for increasing the daily payment limit as well as the advantages and risks associated with higher card limits.

Reasons for Increasing Daily Payment Limit

There are several reasons why you may want to increase the daily payment limit on your N26 Card. Some of the key reasons include:

- Large Purchases: Increasing the daily payment limit allows you to make large purchases without the need for multiple transactions or requesting temporary limit increases.

- Travel Expenses: If you frequently travel or plan to make international transactions, increasing the daily payment limit can accommodate higher expenses associated with travel.

- Online Shopping: With the rise of e-commerce, online shopping has become a popular way to make purchases. Increasing the daily payment limit enables you to make larger online transactions without hassle.

Advantages of Increased Card Limits

Increasing the daily payment limit on your N26 Card offers several advantages. Some of the key advantages include:

- Convenience: With a higher card limit, you can make larger transactions or purchases without the need to split payments or wait for temporary limit increases.

- Financial Flexibility: A higher card limit provides you with the flexibility to manage your finances more effectively, whether it’s handling unexpected expenses or taking advantage of special offers or opportunities.

- Streamlined Transactions: Increasing the daily payment limit reduces the need for additional steps or processes when making transactions, allowing for a smoother and more seamless payment experience.

Risks Associated with Higher Card Limits

While increasing the daily payment limit can be advantageous, it is important to be aware of the potential risks associated with higher card limits. Some of the key risks include:

- Increased Fraud Risk: A higher card limit may make your account more attractive to fraudsters. It is important to remain vigilant and ensure that you are taking appropriate security measures to protect your financial information.

- Impulsive Spending: With a higher card limit, there is a risk of overspending or making impulsive purchases. It is crucial to maintain a responsible approach to your finances and ensure that you are budgeting and spending within your means.

- Potential Financial Strain: While a higher card limit can provide financial flexibility, it is important to consider your overall financial situation and avoid relying solely on credit for expenses. It is recommended to maintain a balanced financial strategy and consider other forms of payment and saving methods.

Steps to Increase the Daily Payment Limit

Increasing the daily payment limit on your N26 Card can be done easily through the N26 mobile app. In this section, we will guide you through the steps to increase the daily payment limit.

Starting the N26 App

To begin the process of increasing the daily payment limit, open the N26 app on your mobile device. If you haven’t already logged in, enter your credentials to access your account.

Navigating to the Settings Section

Once you are logged in to the N26 app, navigate to the settings section. This can typically be found in the main menu or the “my account” section of the app.

Finding the Card Limit Adjusting Feature

Within the settings section, look for the card settings or a similar option. Here, you will find various card-related features, including the option to adjust the daily payment limit. Select this option to proceed with increasing the limit.

Increasing the Limit on Specific Cards

If you have multiple cards linked to your N26 account, you may have the option to increase the daily payment limit on specific cards. To do this, select the specific N26 card for which you want to increase the limit.

Understanding the Impact on Overall Card Limit

When increasing the daily payment limit on specific cards, it’s important to consider the impact on your overall card limit. The total limit across all your linked cards may have a maximum threshold, and adjusting limits on specific cards may affect the distribution of the overall limit.

Factors to Consider when Adjusting Limits on Specific Cards

When deciding to increase the daily payment limit on specific cards, it is important to consider factors such as your spending habits, financial goals, and the importance of each card in your financial strategy. It is recommended to make adjustments that align with your individual needs and requirements.

Confirming the New Limit

Once you have adjusted the daily payment limit, you may need to confirm this change for security purposes. The N26 app may prompt you to authenticate this change through additional security measures, such as biometric authentication or entering a verification code.

Possible Delays in Activating the New Limit

After confirming the new limit, it is important to note that there may be a short delay in activating the new limit. This delay allows N26 to process the change and ensure the security and integrity of your account.

Checking the Updated Limit

Once the new limit is activated, you can check the updated daily payment limit on your N26 Card through the N26 app. This allows you to verify that the limit has been successfully adjusted to your desired amount.

Handling Larger Transactions and Online Purchases

Increasing the daily payment limit on your N26 Card empowers you to handle larger transactions and online purchases with ease. In this section, we will explore the benefits of a higher limit for large transactions, understand the risk of large online purchases, and ensure safe and secure online transactions.

Benefits of a Higher Limit for Large Transactions

A higher daily payment limit on your N26 Card provides several benefits when it comes to handling large transactions. Some of the key benefits include:

- Convenience: With a higher limit, you can make large transactions in a single payment, eliminating the need for multiple transactions or additional authorization steps.

- Time-saving: Making large transactions in a single payment saves time as it reduces the need to track multiple transactions or wait for individual payments to be processed.

- Streamlined Record-keeping: A single transaction for a large amount simplifies record-keeping and makes it easier to track and monitor your expenses.

Understanding the Risk of Large Online Purchases

While a higher daily payment limit enables you to make large online purchases, it is important to understand the associated risks. Some of the key risks of large online purchases include:

- Fraud Risk: Large online purchases may attract fraudsters who target high-value transactions. It is important to ensure that you are using secure websites or platforms and taking appropriate security measures to protect your financial information.

- Return and Refund Policies: Large online purchases may have different return and refund policies compared to regular purchases. It is important to review the terms and conditions of the purchase and ensure that you are aware of any potential limitations or restrictions.

- Disputes and Resolutions: In the event of issues or disputes with a large online purchase, the resolution process may be more complex compared to regular transactions. It is recommended to familiarize yourself with the dispute resolution process of the merchant or platform before making a large online purchase.

Ensuring Safe and Secure Large Online Transactions

To ensure safe and secure large online transactions, it is important to follow best practices and take appropriate security measures. Some of the key measures you can take include:

- Secure Websites and Platforms: Only make online purchases from secure and reputable websites or platforms. Look for HTTPS in the website URL, which signifies a secure connection.

- Two-Factor Authentication: Enable two-factor authentication whenever possible to provide an additional layer of security for your online transactions. This typically involves receiving a verification code on your mobile device to confirm the transaction.

- Review and Monitor Your Statements: Regularly review your bank statements and transaction history to identify any unauthorized or suspicious activity. If you notice anything unusual, report it to your bank immediately.

Managing Finances More Flexibly

Increasing the daily payment limit on your N26 Card provides you with the opportunity to manage your finances more flexibly. In this section, we will explore the key financial advantages of a higher card limit, creating a spending plan with a higher limit, and successfully managing finances with the increased limit.

Key Financial Advantages of a Higher Card Limit

A higher daily payment limit offers several financial advantages that can improve your financial management. Some of the key advantages include:

- Emergency Expenses: With a higher limit, you can handle unexpected expenses or emergencies without disruption to your financial plans.

- Special Offers and Opportunities: A higher card limit allows you to take advantage of special offers or investment opportunities that may require a larger upfront payment.

- Financial Flexibility: A higher card limit provides financial flexibility, enabling you to adjust your spending and payment strategies based on your individual needs and goals.

Creating a Spending Plan with a Higher Card Limit

When you increase the daily payment limit on your N26 Card, it is important to create a spending plan that aligns with your financial goals and priorities. To create a spending plan, consider the following steps:

- Assess Your Financial Goals: Determine your short-term and long-term financial goals, such as saving for a major purchase, paying off debt, or investing in your future.

- Prioritize Your Expenses: Identify your essential expenses, such as rent, utilities, and groceries, and allocate a portion of your card limit to cover these expenses.

- Allocate for Discretionary Spending: Determine how much of your card limit you are comfortable allocating for discretionary spending, such as dining out, entertainment, or shopping.

- Review and Adjust Regularly: Regularly review and adjust your spending plan based on changes in your financial circumstances, goals, or priorities.

Successfully Managing Finances with Increased Limit

To successfully manage your finances with an increased daily payment limit, consider implementing the following strategies:

- Track and Monitor Your Expenses: Utilize the budgeting tools provided by the N26 mobile app to track and monitor your expenses, ensuring that you are staying within your planned spending limits.

- Set Savings Goals: Establish savings goals and allocate a portion of your card limit towards savings. Automate regular transfers to a separate savings account to ensure that you are consistently saving towards your goals.

- Review and Adjust Regularly: Regularly review your financial situation and adjust your spending and saving strategies as needed. This allows you to stay on track with your financial goals and make necessary adjustments based on changes in your circumstances.

Engagement with the N26 Community

Engaging with the N26 community can provide valuable insights, tips, and tricks to enhance your banking experience. In this section, we will explore ways to share experiences and questions, learn from fellow N26 users, and interact with Media Magnet Guide.

Sharing Experiences and Questions

Engaging with the N26 community involves sharing your experiences, asking questions, and seeking advice from fellow users. This can be done through various platforms, such as online forums, social media groups, or the comments section of N26 tutorials and resources.

Learning from Fellow N26 Users’ Tips and Tricks

N26 users often have unique tips and tricks that can enhance your banking experience. By actively participating in the N26 community, you can learn from fellow users and gain insights into how to make the most of your N26 Card and mobile banking platform.

Subscribing and Interacting with Media Magnet Guide

Media Magnet Guide provides valuable tutorials and resources on N26 and other tech-related topics. By subscribing to Media Magnet Guide and interacting with their content, you can stay updated on the latest tips, tutorials, and industry news to enhance your tech knowledge.

Additional Resources on N26

In addition to the N26 community and Media Magnet Guide, there are various resources available to explore more about N26 and its features. Some of the key resources include:

- Exploring More Tech Tutorials: Apart from Media Magnet Guide, there are several other tech tutorial platforms available online that provide in-depth guides and resources on N26 and other tech-related topics. These tutorials can help you further enhance your banking experience and understand the functionalities and features of the N26 Card.

- Accessing Additional Information on mediamagnetguide.com: Media Magnet Guide’s website offers additional information, tutorials, and tips on various topics, including N26. By visiting the website, you can access a wealth of knowledge to enhance your understanding of N26 and its capabilities.

- Staying Up-to-date with Upcoming Tutorials and Tips: By following N26’s official website and social media channels, you can stay updated on the latest tutorials, tips, and updates related to N26. This ensures that you are aware of any new features or enhancements that may impact your banking experience.

Conclusion

Increasing the daily payment limit on your N26 Card provides you with the flexibility to manage your finances more effectively and handle larger transactions or online purchases. In this article, we explored the features and benefits of the N26 Card, the steps to increase the daily payment limit, and the advantages and risks associated with higher card limits. We also discussed how to handle larger transactions and online purchases, manage finances more flexibly, engage with the N26 community, and access additional resources on N26. By following the steps outlined in this article and leveraging the benefits of the N26 Card, you can enhance your financial management and enjoy a seamless banking experience.