In the video titled “How to Remove Tax Included on Shopify,” presented by Media Magnet Guide, you will discover effective methods to remove or adjust the tax included in prices within your Shopify store’s settings. This tutorial aims to assist Shopify users in optimizing their online stores by providing step-by-step instructions on how to remove tax inclusion from product pages. The video suggests navigating to the settings section of your Shopify store, locating the tax settings, and disabling the option to show all prices with tax included. By following these straightforward guidelines, you can successfully remove tax inclusion and enhance the efficiency of your Shopify store. If you found this tutorial helpful, don’t forget to like the video and consider subscribing for more valuable content on Shopify and e-commerce strategies.

In this video tutorial, we will demonstrate how to remove tax inclusion from your Shopify product pages. Before we get started, we invite you to hit the like button if you are excited to learn about this process. Feel free to share your thoughts in the comments below, and if you are interested in trying out Shopify for your e-commerce needs, click the link in the description to get started. To remove tax inclusion, simply navigate to the settings option in the bottom left corner of your Shopify store’s backend. Scroll down until you find the taxes section, and within the tax settings, you will see different tax regions. Locate the option for tax calculations and look for “show all prices with tax included.” By disabling this option and clicking save, you will successfully remove tax inclusion from your product pages. We hope this tutorial was helpful, and remember to like and consider subscribing for more valuable content like this. If you are interested in trying Shopify, visit our website for additional tutorials.

Understanding Shopify Tax Settings

What Shopify Tax Settings are

Shopify Tax Settings refer to the configuration options available within the Shopify platform that allow you to manage and calculate taxes for your online store. These settings determine how taxes are calculated, displayed, and included in the prices of your products and services.

Importance of Shopify Tax Settings

Properly configuring your Shopify Tax Settings is crucial for maintaining compliance with tax regulations and ensuring accurate tax calculations for your customers. Failing to set up tax settings correctly can result in legal issues, financial penalties, and a negative customer experience. It is essential to understand and utilize these settings to efficiently manage and process taxes within your Shopify store.

How Shopify Tax Settings Affect Your Store

Shopify Tax Settings have a direct impact on your online store in multiple ways. They determine how taxes are displayed to customers, how taxes are calculated at the checkout, and how your store complies with local tax laws. By configuring these settings correctly, you can provide a transparent and seamless checkout experience for your customers while maintaining tax compliance and accurately managing your business’s financials.

Accessing Shopify Admin Panel

How to Login into Shopify Admin Panel

To access the Shopify Admin Panel, follow these steps:

- Open your web browser.

- Enter the Shopify website address (www.shopify.com) into the URL bar.

- Click on the “Log In” button located at the top-right corner of the Shopify homepage.

- Enter your Shopify store’s login credentials (email and password) into the provided fields.

- Click the “Log In” button to access your Shopify Admin Panel.

Understanding Shopify Admin Panel Options

Once logged in to the Shopify Admin Panel, you will have access to various options and features that allow you to manage and customize your online store. These options include managing orders, products, customers, themes, settings, and more. Familiarizing yourself with the different options available in the Shopify Admin Panel is crucial for effectively managing your online store and making necessary modifications as needed.

Locating the Settings Option in Shopify Admin Panel

To find the Settings option in the Shopify Admin Panel, follow these steps:

- After logging in to the Shopify Admin Panel, locate the sidebar menu on the left side of the screen.

- Scroll down the sidebar menu until you find the “Settings” option.

- Click on the “Settings” option to access the settings menu, which contains various configuration options for your Shopify store.

Navigating to Shopify Tax Settings

How to Find Shopify Tax Settings

To locate the Shopify Tax Settings within the Shopify Admin Panel, follow these steps:

- After accessing the Shopify Admin Panel, click on the “Settings” option in the sidebar menu.

- In the settings menu, you will see a list of different configuration options.

- Scroll down the settings menu until you find the “Taxes” option.

- Click on the “Taxes” option to access the Shopify Tax Settings.

Understanding Shopify Tax Settings Options

Within the Shopify Tax Settings, you will find various options that allow you to customize how taxes are calculated and displayed in your online store. These options include tax regions, tax rates, tax exemptions, tax calculation settings, tax inclusion settings, and more. By understanding and utilizing these options effectively, you can ensure accurate tax calculations and compliance with tax regulations.

Locating Tax Calculation Settings

To locate the Tax Calculation Settings within the Shopify Tax Settings, follow these steps:

- After accessing the Shopify Tax Settings, scroll down until you find the “Tax Calculation Settings” section.

- Within the Tax Calculation Settings, you will see different options related to tax calculations, including the display of taxes at the checkout, rounding options, and tax calculation based on shipping address or billing address.

Understanding Tax Inclusion in Shopify

What is Tax Inclusion in Shopify

Tax inclusion in Shopify refers to the practice of including taxes in the displayed prices of products and services on your online store. When tax inclusion is enabled, the prices shown to customers already include the applicable taxes, resulting in a simplified and transparent shopping experience.

How Shopify Calculates Taxes

Shopify calculates taxes based on the tax rates you set up within the Shopify Tax Settings. When a customer adds a product to their cart, Shopify uses the customer’s shipping or billing address to determine the tax rate applicable to their location. The tax is then calculated based on this rate and included in the total price displayed during the checkout process.

Pros and Cons of Tax Inclusion in Shopify

Pros

- Simplifies the shopping experience for customers by providing transparent and all-inclusive prices.

- Reduces confusion and surprises during the checkout process.

- Can make your store more appealing to customers who prefer knowing the final price upfront.

Cons

- Requires careful calculation and setup of tax rates to ensure accuracy and compliance.

- May result in higher displayed prices compared to competitors who do not include taxes.

- Can make the product prices seem higher, potentially deterring price-conscious customers.

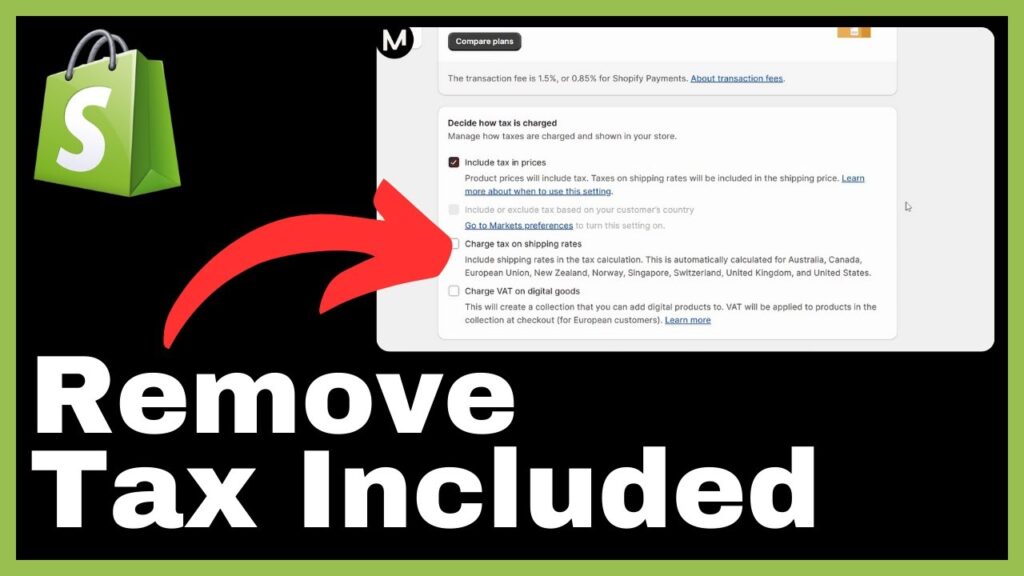

Removing Tax Included in Shopify

Locating Tax Inclusion Option

To locate the Tax Inclusion option within the Shopify Tax Settings, follow these steps:

- Access the Shopify Tax Settings as previously outlined.

- Scroll down the Tax Settings page until you find the “Tax Inclusion” section.

Disabling Tax Inclusion

To disable tax inclusion in Shopify, follow these steps:

- Within the Tax Inclusion section, you will see an option to “Show all prices with tax included.”

- If this option is enabled (checked), click on it to disable tax inclusion.

- Make sure to save your changes by clicking the “Save” button at the top-right corner of the page.

Validating Changes in Tax Settings

After disabling tax inclusion in Shopify, it is essential to validate the changes to ensure that taxes are no longer included in the displayed prices. Test the checkout process using different products and customer locations to ensure that taxes are calculated accurately and displayed separately from the product prices.

Effects of Removing Tax Inclusion

How Product Prices are Affected

By removing tax inclusion in Shopify, the displayed product prices will no longer include the applicable taxes. Customers will see the base price of the products without any taxes added. This may result in lower displayed prices compared to when tax inclusion was enabled.

Changes in Checkout Process

When tax inclusion is removed, customers will see the taxes calculated separately during the checkout process. The taxes will be displayed as an additional charge alongside the product prices. This provides transparency and clarity regarding the tax amount the customer is paying.

Impact on Sales and Customer Behavior

Removing tax inclusion from Shopify may have an impact on sales and customer behavior. Some customers may appreciate the transparency of seeing taxes calculated separately, while others may be deterred by higher displayed prices. It is important to monitor customer reactions and sales data to assess the impact of this change and make adjustments as necessary.

Restoring Tax Inclusion

How to Enable Tax Inclusion in Shopify

To enable tax inclusion in Shopify, follow these steps:

- Access the Shopify Tax Settings as previously outlined.

- Scroll down to the Tax Inclusion section.

- If the “Show all prices with tax included” option is disabled (unchecked), click on it to enable tax inclusion.

- Save your changes by clicking the “Save” button at the top-right corner of the page.

Why You Might Need to Restore Tax Inclusion

There are several reasons why you might need to restore tax inclusion in Shopify. These reasons include customer preferences, legal requirements, market competition, and the overall shopping experience you want to provide for your customers. By enabling tax inclusion, you can simplify the pricing structure and potentially attract customers who value all-inclusive pricing.

Changes After Restoring Tax Inclusion

After restoring tax inclusion in Shopify, the displayed product prices will include the applicable taxes. Customers will see an all-inclusive price without the need to calculate or add taxes during the checkout process. This can create a more straightforward and seamless shopping experience for your customers.

Helpful Shopify Tax Plugins

Popular Shopify Tax Plugins

There are several tax plugins available for Shopify that can automate tax calculations and provide additional features. Some popular Shopify tax plugins include:

- TaxJar

- Avalara AvaTax

- Taxify

- Bold Cashier

- Quaderno

How Tax Plugins Can Automate Tax Calculation

Tax plugins for Shopify utilize integrations with tax calculation services and APIs to automate tax calculations based on customer locations. These plugins can update tax rates in real-time, handle complex tax scenarios, and provide accurate tax reports and calculations for tax compliance.

Considerations when Picking a Shopify Tax Plugin

When choosing a Shopify tax plugin, consider the following factors:

- Integration with your existing tax backend or service, if applicable.

- Comprehensive support for tax regulations and requirements in your target markets.

- User-friendly interface and ease of configuration.

- Compatibility with other plugins or apps you use in your Shopify store.

- Pricing and scalability based on your business needs.

Additional Shopify Tax Tips and Tricks

Setting Up Different Tax Rates

If your business operates in multiple regions with different tax rates, Shopify allows you to set up different tax rates for each region. This ensures accurate tax calculations based on customer locations and helps you comply with local tax regulations.

Managing Tax Exemptions

In some cases, certain customers or products may be exempt from sales tax, such as wholesale transactions or non-taxable items. Shopify provides options to manage tax exemptions by creating exemption rules or adding specific exemptions for customers or products. Be sure to consult with a tax professional or local tax authority to ensure compliance when managing exemptions.

Keeping Up with Tax Law Updates

Tax laws and regulations are subject to change, so it is essential to stay updated on any tax law changes that may affect your business. This includes changes in tax rates, reporting requirements, or tax-exempt statuses. Regularly review tax publications, consult with tax professionals, and stay informed about updates from relevant tax authorities.

Conclusion

In this comprehensive article, we have explored the concept of Shopify Tax Settings and discussed their importance for managing taxes in your online store. We have covered various aspects, including accessing the Shopify Admin Panel, navigating to the Tax Settings, understanding tax inclusion, removing tax inclusion, the effects of removing tax inclusion, restoring tax inclusion, helpful tax plugins, additional tax tips and tricks, and the importance of keeping up with tax law updates. By implementing the insights provided in this article, you can effectively manage tax settings in your Shopify store, ensure compliance, and provide a seamless shopping experience for your customers.